Chloroprene Rubber: Anti-Dumping Policies Continue, Basic Fundamentals Are the Main Influencing Factors.

Translation: [Introduction] On May 9, 2023, the Ministry of Commerce issued Announcement No. 17, stating that China's imports of chloroprene rubber would continue to be subject to the previous anti-dumping policies, which had no significant impact on the market. Recently, the prices of calcium carbide have been consolidating within a narrow range, and the main factors affecting the price trend of chloroprene rubber market are the market fundamentals. In the future, there may be domestic and international plant maintenance plans that could provide some support to the market. With expectations of weak domestic market demand, short-term chloroprene rubber market prices are expected to remain stable or experience a slight adjustment.

Recently, the supply-demand imbalance in the chloroprene rubber market has continued, with prices generally stable and slightly weak. The Ministry of Commerce recently concluded a year-long final review of anti-dumping measures on chloroprene rubber, indicating that China's imports of chloroprene rubber would continue to be subject to the existing anti-dumping policies, which had no significant impact on the current market. The supply-demand fundamentals remain the main influencing factor in the market.

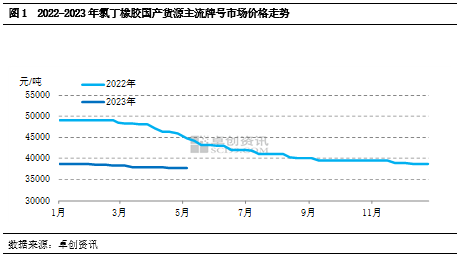

Prices in the market are generally stable with a slight weakness. In the second quarter, domestic chloroprene rubber market prices continued to show a weak trend. Some domestic suppliers faced pressure to sell at lower prices, while importers were relatively cautious in making purchases, resulting in limited overall imports. However, there were still instances of low-price transactions in the market as the previous stockpiles were gradually consumed, leading to a gradual reduction in social inventories. Downstream purchasing remained sluggish, and overall market negotiations were somewhat chaotic, resulting in transactions at lower prices. As of May 15, the price of domestically produced CR244 in the East China market was around 36,500-37,000 yuan per ton, a decrease of 0.68% compared to the end of March and a decrease of 12.50% year-on-year.

As for the main factors influencing market prices, the recent fluctuations in calcium carbide prices have not provided sufficient guidance for the direction of chloroprene rubber prices. The main influencing factors are supply and demand:

Supply: Overall sufficient supply with differences between imports and domestic production

In April, domestic chloroprene rubber factories operated at normal levels, and with relatively high inventories in some domestic factories, there was a gradual accumulation of stockpiles since the beginning of the year. Overall, the supply of domestic products has been relatively sufficient. As the scheduled maintenance periods of domestic plants were gradually determined, domestic traders showed reduced willingness to sell at low prices, but there were still instances of low-price transactions due to existing inventory pressure. Regarding imports, the total import volume from January to March was relatively low. According to customs data, the total import volume for the first three months of 2023 was approximately 1,947.48 tons, a decrease of 55.26% compared to the same period last year. In addition, as previous stockpiles were gradually consumed, overall importers and downstream inventories were relatively low, resulting in a gradual reduction in low-price transactions. However, market negotiations remained relatively stable.

Demand: Weak domestic performance with relatively high export levels

In April, downstream product manufacturers and adhesive companies operated at lower capacities compared to previous years, and their purchasing intentions decreased in the second half of the month, resulting in a slowdown in supplier shipments. Regarding sales volumes of two domestic factories in April, the overall month-on-month increase was around 8%, but significantly lower than the same period last year. In terms of exports, the overall performance was relatively good. According to customs data, the total export volume from January to March was 5,897.53 tons, a year

Send Email

Send Email 18268800353

18268800353